what triggers net investment income tax

The net investment income tax targeted primarily toward the wealthy is an additional tax on top of regular tax liability. 4 Tax Triggers New Investors Need to Know About 1.

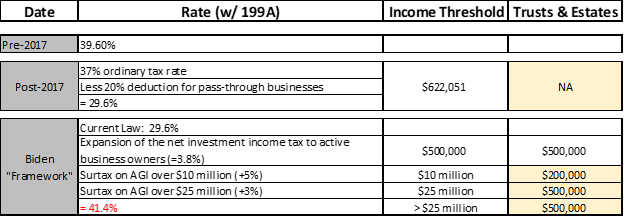

Assault On Family Businesses Continues The S Corporation Association

You sold shares at a profit What might.

. You are charged 38 of the lesser of net investment. Capital gains and qualified dividends are included in net investment income so the NIIT effectively increases the maximum tax rate on those sources of income. The net investment income tax is a complex tax law that can surprise unwitting taxpayers who have a one-time increase in investment income such as from selling an.

Net Investment Income Tax. For the purposes of calculating net investment income NII the IRS looks at income derived from investments before any applicable taxes are applied such as bonds. Net investment income tax is an additional tax that applies to high-earning individuals who owe capital gains tax.

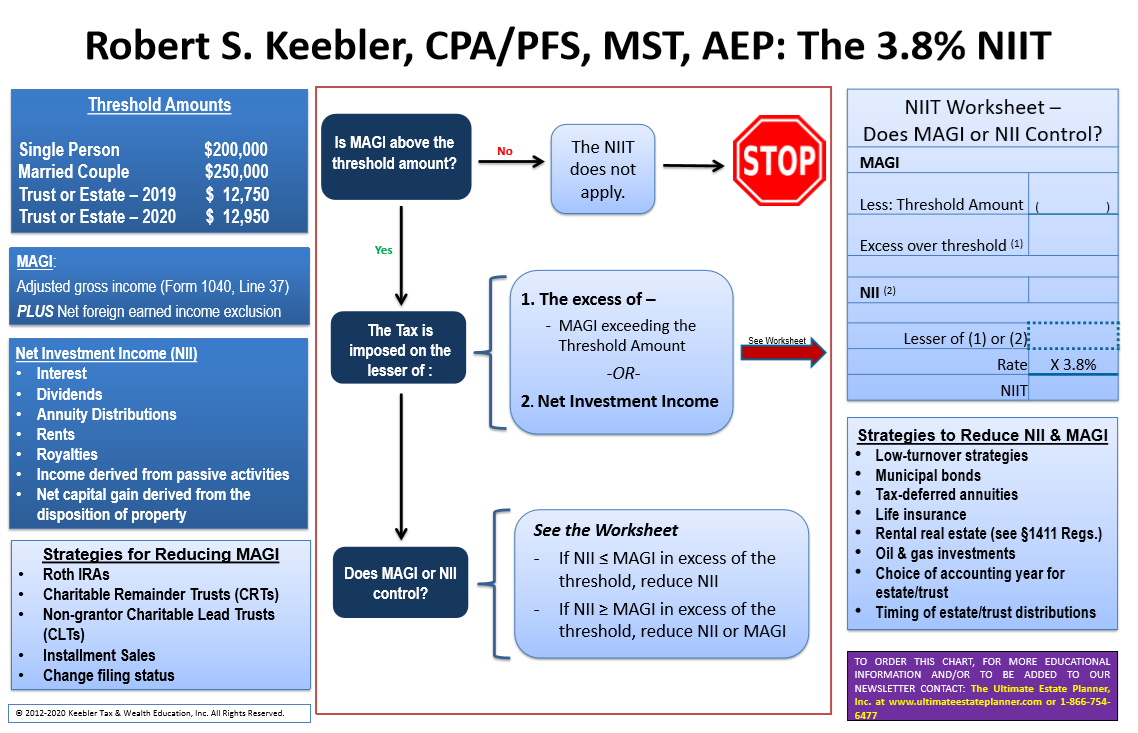

Nonetheless for those who do have investment income and it is in the crossover zone its crucial to recognize taxable events from retirement accounts can trigger the 38. Individuals who pay net investment income tax also pay. It uses your MAGI modified adjusted gross income as income.

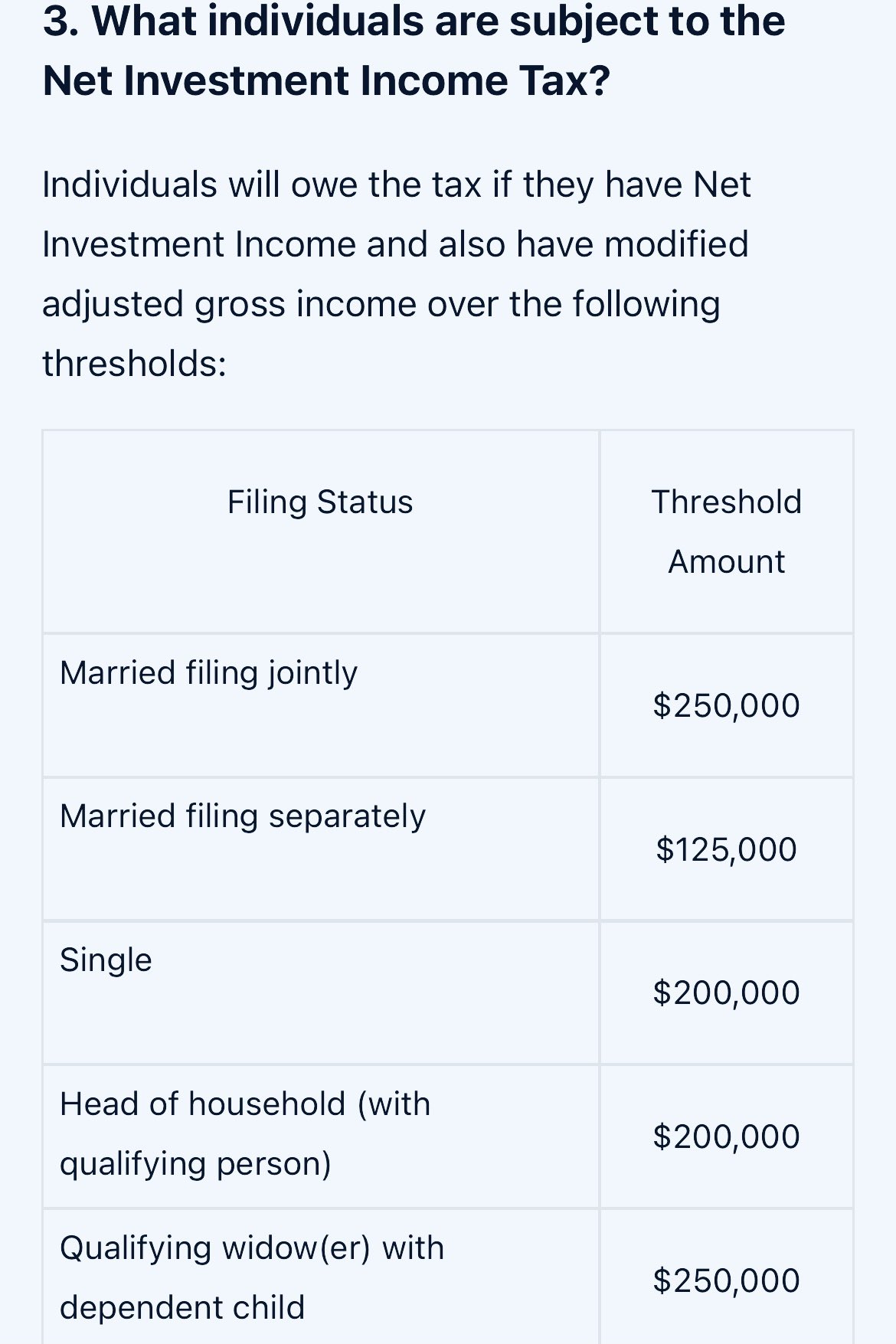

You may have to pay net investment income tax when you profit from. Calculate Your Net Investment Income Tax Liability The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI. NIIT is an income threshold-based tax.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Fortunately proper planning and the assistance of a. While those new higher income tax rates apply only to taxable income exceeding 406750 for a single or 457600 for a couple in 2014 the NIIT reaches down the income.

But IRA distributions can. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross income exceeds the. The IRS gives you a pass.

If youre a new investor here are four things that could trigger a tax-related hit and what tax pros say you can do to soften the blow. Net Income Investment Tax Defined. One trick to this.

The sale of stocks bonds and mutual funds. The Net Investment Income Tax or NII is not truly a tax at least not in the purest sense of the word. Although it has been established that the sale of a shareholders personal goodwill may generate capital gain to the shareholder a related.

Enacted as part of the Affordable Care Act the intent was to have higher income.

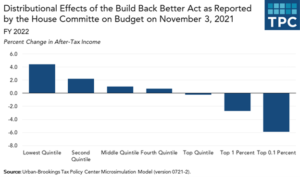

The Build Back Better Plan Save Your Tax Dollars Before The Year S End Altfest

Easy Net Investment Income Tax Calculator

![]()

Implementation Of The New 3 8 Net Investment Income Tax For S Corporations And Their Shareholders

Ron Pragides On Twitter Paulg Top Long Term Capital Gains Tax 20 Federal 3 8 Niit 13 3 Ca Net Investment Income Tax Https T Co 6rzneijx2z Https T Co Kut9v2hrc3 Twitter

California State Taxes What You Need To Know Russell Investments

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

By Overturning The Aca The Supreme Court Would Cut Taxes Substantially For High Income Households Tax Policy Center

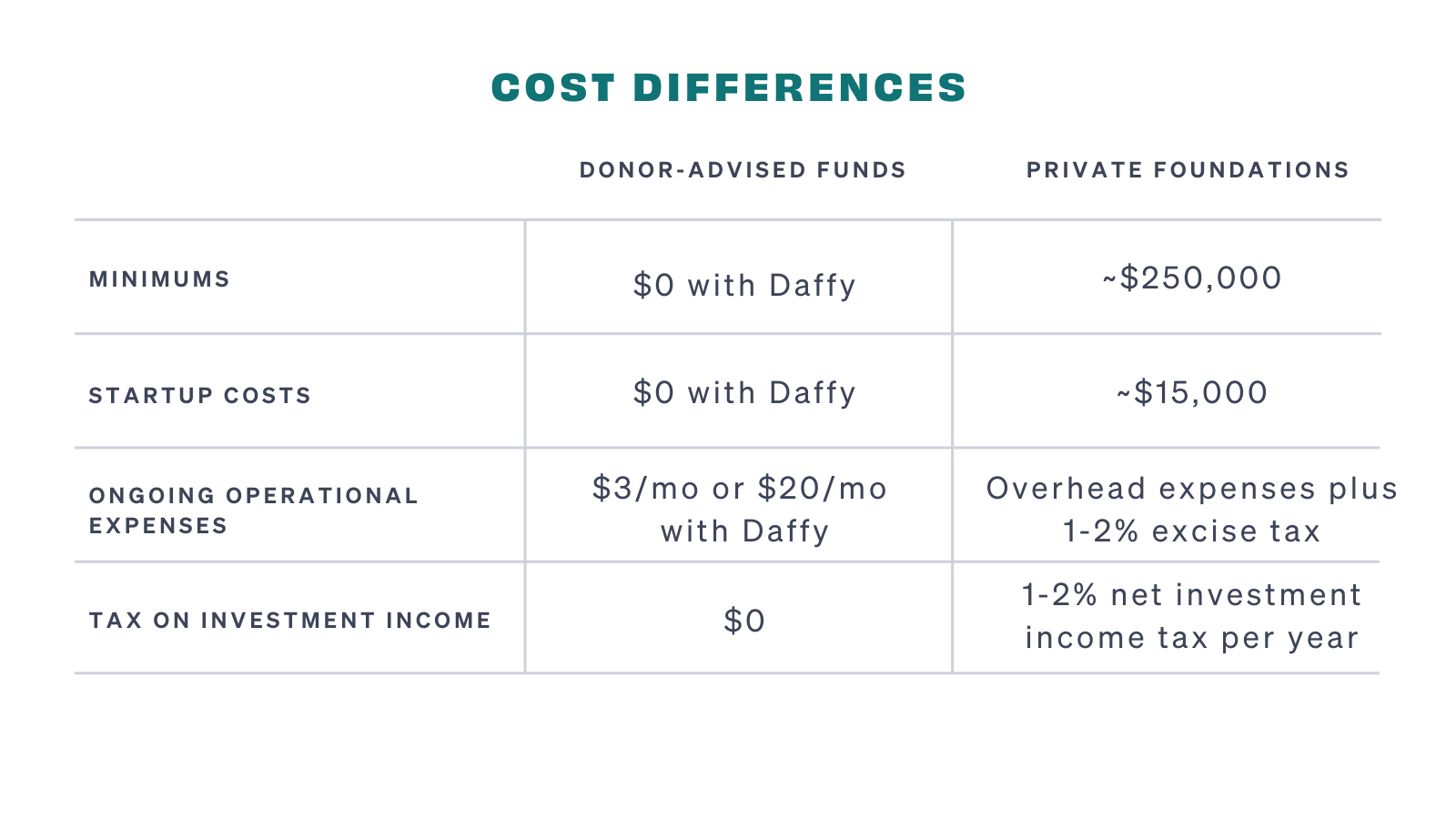

Donor Advised Funds Vs Private Foundations What S Best

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Four Things To Know About Net Investment Income Tax Htj Tax

Investment Expenses What S Tax Deductible Charles Schwab

Plan Ahead For The 3 8 Net Investment Income Tax Mauldin Jenkins

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Planning For The Parallel Universe Of The Net Investment Income Tax

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Income Is 450 000 What Is His Income Tax And Net Investment Income Tax Liability In Each Cliffsnotes

How To Avoid The 3 8 Medicare Surtax On Investment Income Marketwatch

Understanding The Net Investment Income Tax Wheeler Accountants

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)